Agent Portal - 360° Agent's Workplace

Discover our comprehensive system for automating the work of insurance agents, trusted by leading insurers such as Warta (HDI/Talanx Group), Allianz and Vienna Insurance Group.

.png)

Agent Portal - 360° Agent's Workplace

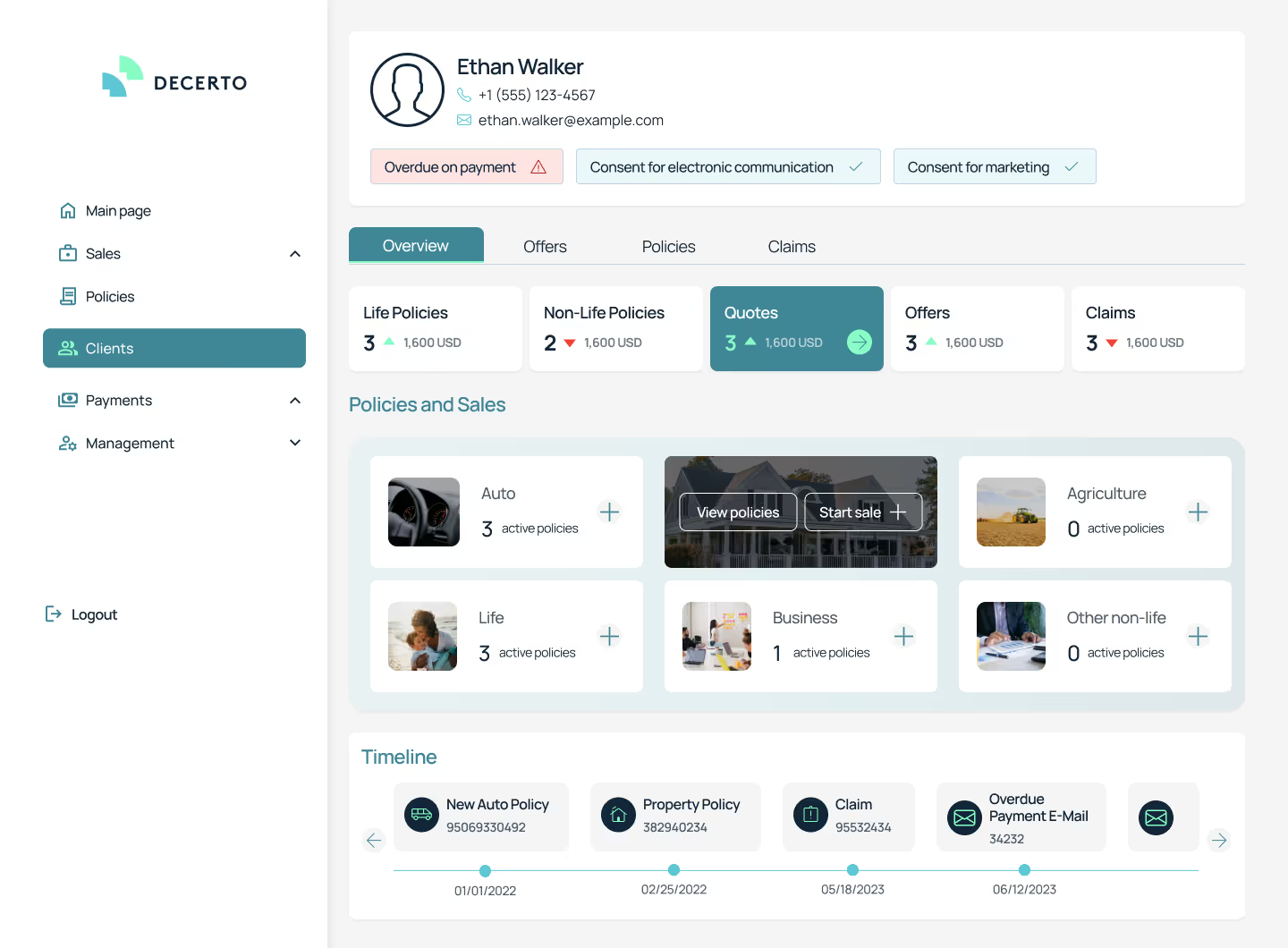

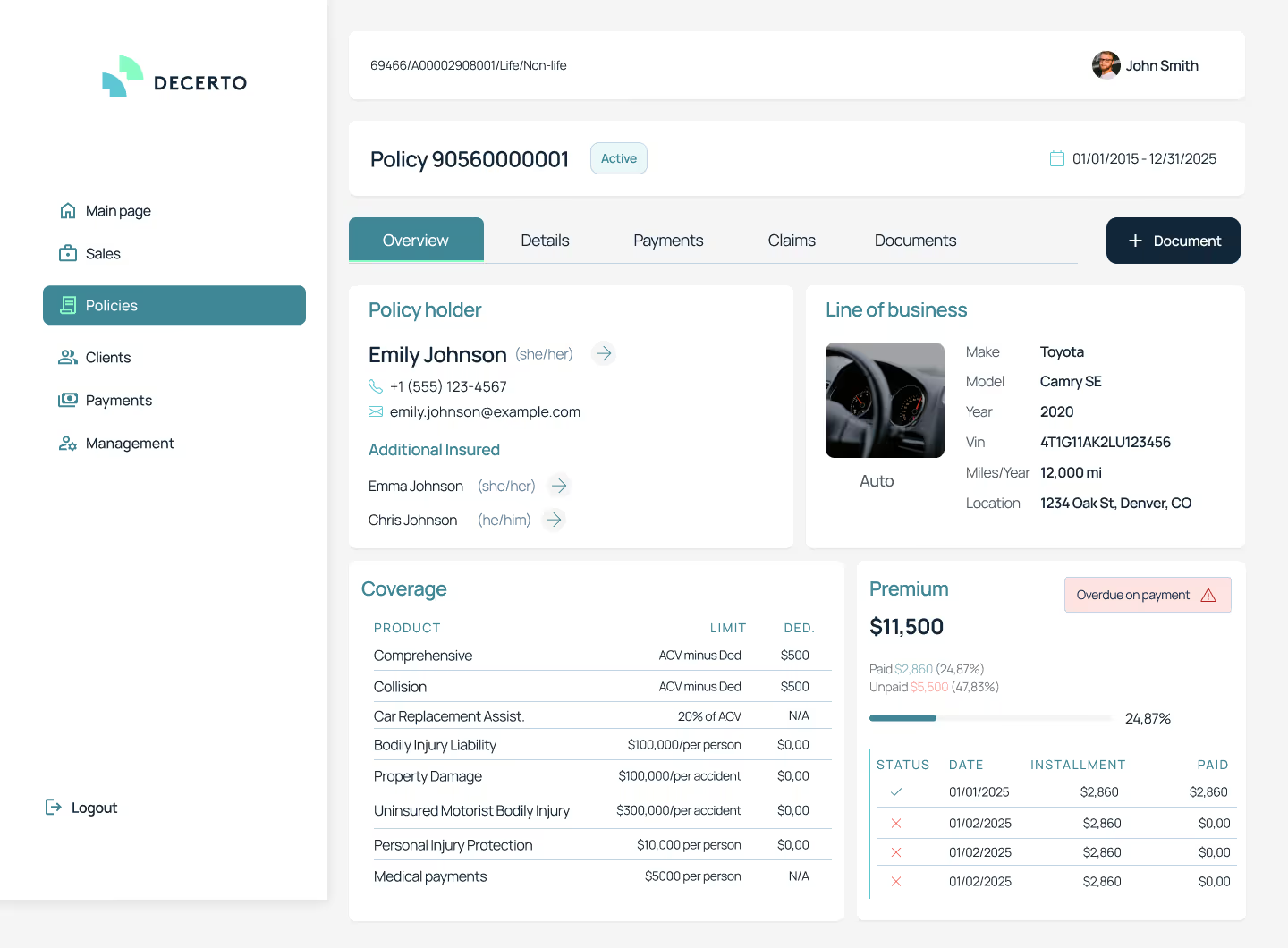

Agent Portal serves as a comprehensive insurance CRM, empowering agents to manage the full sales workflow - from initial quoting and calculations to policy issuance, post-sale service, and customer support. This enables agents to operate efficiently, deliver exceptional client service, and drive better sales outcomes.

Access to real-time information

and KPIs

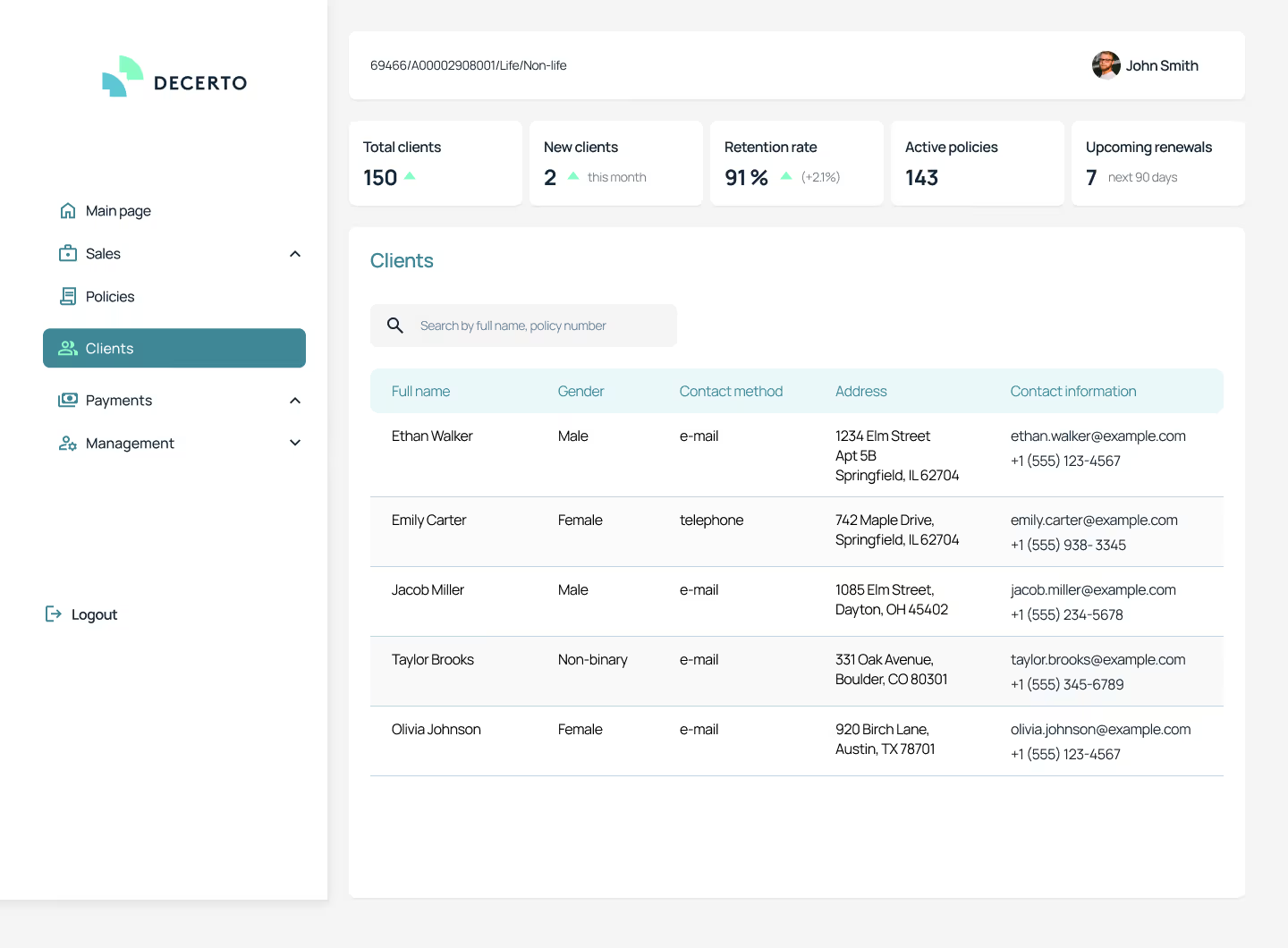

The Agent Portal gives agents and managers instant access to personalized data on sales performance, client portfolios, and commissions, enabling real-time performance tracking and informed business decision-making.

Automation of sales and post-sales processes

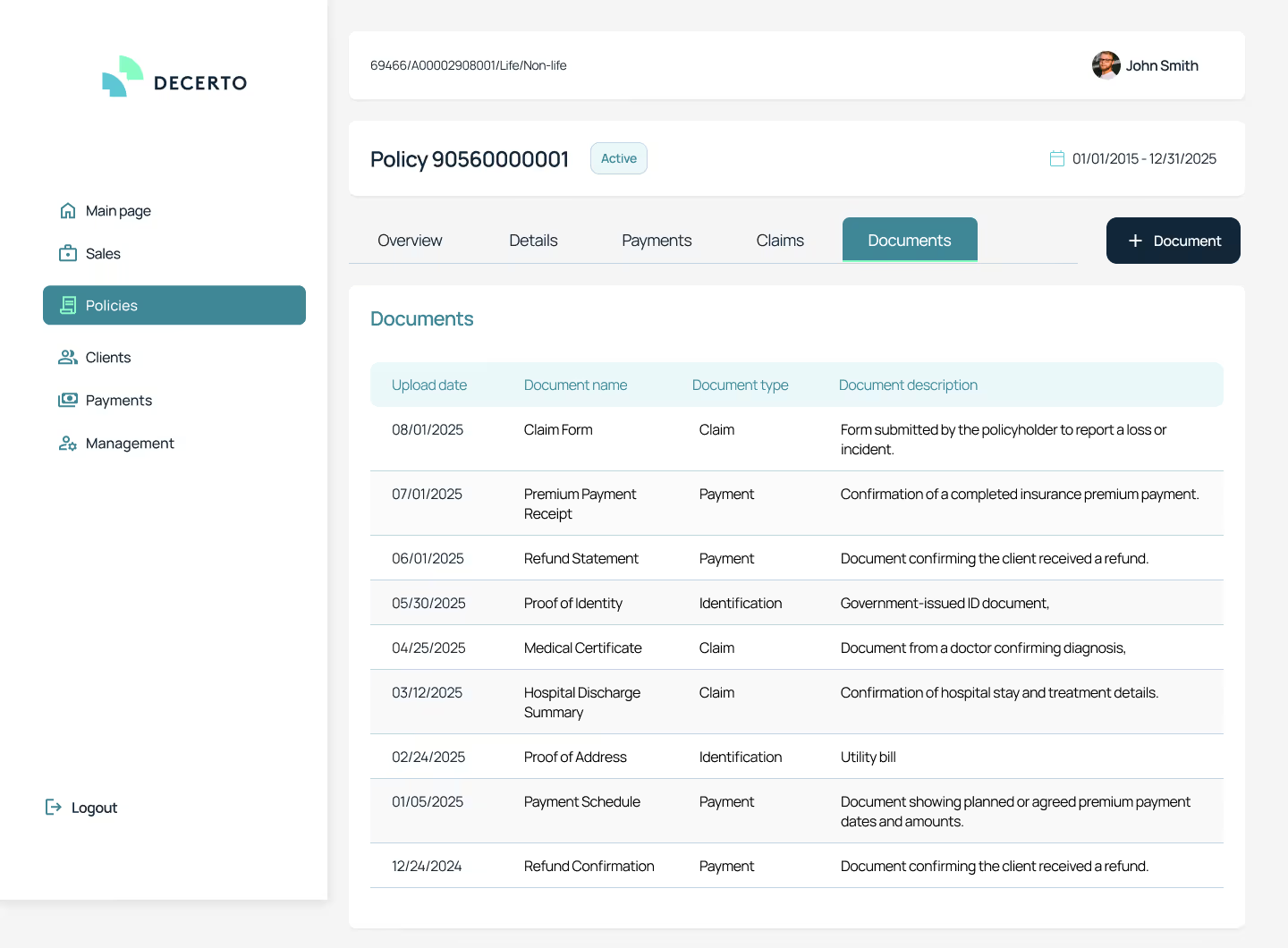

The system automates the entire policy lifecycle, from rapid multi-carrier quoting and binding to handling renewals, which significantly reduces an agent's administrative workload and minimizes the risk of errors.

Scalability and architectural flexibility

Its modern, microservices-based architecture ensures high system performance, even with a large number of users, and allows for easy expansion and flexible integration with other tools.

Everything In One Place

Empower your network of insurance agents with an intuitive and comprehensive tool that enables them to effortlessly sell insurance products, access client information and portfolios, and carry out their daily activities on a centralized platform.

6 Modules That You Buy Together Or Separately

Our insurance software for insurers as an all-in-one solution. It is made up of 6 modules: Sales, 360 Customer View, 360 Agent View, Sales Dashboards, Post-Sale and Claims, Commission & Billing.

Sales Module

Accelerate the sales process by better matching offers to customer needs (customer experience).

360° Customer View Module

Gain full customer view based on real-time information from several sources.

360° Agent View Module

Explore business data insights, communication tools and sales support solutions for agents.

Key Technology Features

Legacy systems and fragmented sales networks are slowing insurers down. Our technology helps you modernize and stay competitive.

Modular Architecture

We adopt a flexible modular architecture for our insurance software. This enables the rapid scaling of specific system components and seamless technology upgrades that can be implemented gradually. With our LEGO-like approach, different applications can be combined effortlessly, allowing for the addition or removal of modules without affecting the rest of the application.

Maximizing Security

Our focus on data security includes preventing the accumulation of customer data in logs, encrypting sensitive information in transmitted messages, and using secure login methods such as Single Sign-On (SSO) and OAuth2. Your connections to our insurance software are encrypted, providing additional security. Independent security audits consistently rate our insurance software highly.

Performance

We want the user experience to be as excellent. We eliminate waiting times and deliver near-instant operations that were previously time-consuming.

Mobile-Ready

Our focus is on creating user interfaces (UI) and experiences (UX) that enable effortless navigation and immediate effectiveness. By utilizing Responsive Web Design (RWD) and, in some cases, Progressive Web Applications (PWA), we enhance accessibility and functionality our insurance software.

Cloud-Ready Software

We design our modules to be containerized, offering seamless deployment in both on-premises and cloud environments. Our approach is rooted in versatility, accommodating your preferences for deploying our product. Whether you choose local application servers, Kubernetes on your own infrastructure, or harnessing the advantages of a cloud provider, our solutions are adaptable.

Scalability

Our insurance software are built to be stateless or synchronize their state using external tools such as databases or queues. This architecture allows for effortless deployment of multiple instances of each module. By leveraging tools like Kubernetes, we dynamically control the number of instances based on the system load, ensuring efficient scaling as per demand.

Omnichannel

We can quickly integrate our insurance software with insurance multi-agencies and add support for direct sales. Our flexible approach enables us to expose various channels through slightly modified sales forms or to design entirely new interfaces, all while seamlessly integrating with backend services via APIs. This solution enables straightforward reporting, which proves useful when analyzing insurance product sales performance across different channels.

API

In designing solutions, we ensure seamless external system communication, offering APIs in REST or SOAP based on needs. We provide these APIs in the OpenAPI standard with Swagger documentation. Prioritizing security, our APIs are safeguarded against unauthorized access using measures like Basic Auth, OAuth2, and OpenID Connect.

Benefits

Used by the world's leading companies

Implement Insurance Software On Time & Within Budget

We present simple steps to ensure a smooth and successful implementation of insurance software. Whether you are upgrading existing systems or implementing new solutions, these tips will help you navigate the process confidently, minimize disruptions, and maximize your return on investment. These are the same steps we follow in our clients' projects.

FAQs

We've gathered answers to the questions we get asked most often.

Agent Portal is an advanced insurance CRM tool specifically designed for insurance agents. It helps manage customer relationships, automate daily tasks, track sales and post-sales activities, and integrate various insurance systems into one platform. This enables insurance agents to work more efficiently, having access to all necessary information in one place.

Yes, Agent Portal utilizes the latest security technologies, such as data encryption, secure login, and regular security audits. The insurance software also complies with international data security standards.

The implementation process for insurance software involves several stages, including needs analysis, technical infrastructure preparation, insurance system configuration and customization, insurance data migration, user training, system testing, and full deployment. Our team of experts supports clients at every stage to ensure a successful implementation.

The costs of using insurance software depend on several factors, such as the number of users, the scope of features, and specific integration requirements. Please contact our sales team for a detailed quote and to learn more about our pricing plans.

Our insurance software offers a range of features, including customer management, automating sales and post-sales processes, generating sales reports and data analysis, document management, seamless integration with other insurance systems, manage claims, policy administration, customizing the user interface.

Yes, our insurance software is designed to easily integrate with other insurance systems, such as policy management systems, CRM systems, and other insurance solutions used by the insurance industry.

Yes, our insurance software is compatible with a range of devices, such as computers, tablets, and smartphones. The mobile application enables insurance agents to utilize all system functionalities wherever they are, enhancing their efficiency and flexibility.

Yes, we provide full technical support after the implementation of insurance software. Our technical support team is available to assist with troubleshooting, answering questions, and providing insurance system updates and maintenance to ensure its optimal performance.

Still have questions?

If you didn’t find the answer to your question on our website, please contact us. We’ll get back to you within 24 hours.

Our Blog

Let’s Build the Future of Insurance Together

Start a conversation with our team and discover how Decerto can accelerate your digital transformation.